Capital One dipped their toes in the premium credit card market at the end of 2021 by releasing the all-new Capital One Venture X. Capital One has long catered to travelers who favor flexibility over airline/hotel loyalty, and the Venture X is no exception. With a 75,000 mile sign-up bonus (reduced from the original 100K offer in 2021) that can be redeemed as a statement credit against any travel-related purchases, Capital One has set their sights firmly on travelers who prefer hassle-free point redemptions.

New cards always generate hype in the points & miles community as people clamor for new bonuses (and referral links), but how can you tell if this card is right for your travel style? Today, we break down some of the pros & cons of this new travel rewards card to help you decide if you should apply for the Capital One Venture X.

Support for this site comes from our readers, and this post contains affiliate links. Consider using the affiliate links below to help the StandbyWithMe team continue creating useful content for travelers like you.

Capital One Venture X Quick Facts

- Annual Fee: $395

- Sign-up Bonus: 75,000 miles (worth $750) after spending $4K in the first 3 months

- Lounge Access: Yes (Capital One lounges & Priority Pass network)

- Travel Credit: $300/year (only redeemable in Capital One Travel portal)

- TSA PreCheck/Global Entry Credit: Yes

- Cell Phone Protection Plan: Yes

- Auto Rental Protection: Yes (Primary)

- Earnings Rate:

- 10x miles on hotel & rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

- Benefits offered for a limited time:

- $200 statement credit for vacation rental purchases

This isn’t your run-of-the-mill credit card: Capital One is putting their best foot forward with this premium travel card. With perks like a TSA PreCheck/Global Entry statement credit & Priority Pass lounge membership, the Venture X is gearing up to go toe-to-toe against the likes of the Chase Sapphire Reserve & Amex Platinum Card.

While these features have come to be expected on premium travel credit cards, the Venture X’s sub-$400 annual fee makes it one of the lowest-cost options in this tier.

As non-rev travelers, it’s important to recognize that what is valuable to other travelers may be different than what we find useful. Let’s take a closer look at some of this card’s features to see if it is worth the $395 annual fee.

75,000 Mile Sign-Up Bonus (approximate value $750)

Capital One miles are worth 1 cent per point when redeemed on travel, so this 75K point sign-up bonus is worth $750 in travel credits.

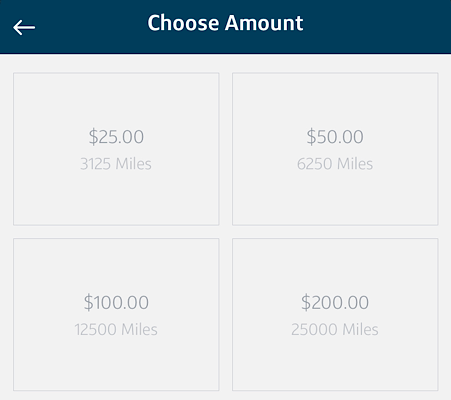

If you have never used Capital One miles before, these miles can redeemed in 4 different ways:

- Applied as a statement credit to travel charges: miles can be redeemed at a fixed $0.01/mile against a broad range of charges including parking charges, transit tickets, ZED fares, and third-party booking apps

- Applied to purchases made via Capital One’s Travel Portal: miles can be redeemed at a fixed $0.01/mile on any Travel Portal purchases

- Transfer to a travel partner’s loyalty program: miles can be transferred to any of 15+ travel loyalty program partners, but the vast majority of these partners won’t be useful for the average non-rev traveler:

- Accor Live Limitless (1:0.5)

- Aeromexico Club Premier (1:1)

- Air France KLM Flying Blue (1:1)

- Air Canada Aeroplan (1:1)

- Asia Miles(1:1)

- Avianca LifeMiles (1:1)

- British Airways Avios (1:1)

- Emirates Skywards (1:1)

- Etihad Airways Guest (1:1)

- EVA Air Infinity MileageLands (1:0.75)

- Finnair Plus (1:1)

- Qantas Frequent Flyer (1:1)

- Singapore Airlines KrisFlyer (1:1)

- TAPAir Portugal Miles&Go (1:1)

- Turkish Airlines Miles&Smiles (1:1)

- Wyndham Rewards (1:1)

- Redeemed for non-travel purchases: using miles for the non-travel expenses listed below is not recommended because these redemption ratios are less than $0.01/mile

- Redeem for cash

- Redeem for gift cards

- Redeem with PayPal

- Shop with Amazon

However, Capital One’s Venture X card required a higher spending requirement than some of its competitors. Thankfully, that was reduced to a more palatable $4,000 in the first 3 months.

Strongly consider your spending habits & expected expenses before deciding to apply for this card; not earning the 75K point bonus would severely limit the value of this card.

If your spending patterns indicate that you can meet the $4k spending requirement in the first 3 months, here is the total expected value of the sign-up bonus:

75,000 miles + 8,000 miles earned (2x miles on $4k minimum spend) = 83,000 miles

Those 83,000 miles can be redeemed for $830 worth of travel, so new cardholders reap an impressive 20.75% overall earnings rate on their $4k minimum spend. That rate only improves if you leverage Capital One’s Travel Portal to earn 5x miles on flights or 10x on hotels/cars.

Capital One Lounges

The most exciting perk offered by the Capital One Venture X is unlimited access to their brand new network of Capital One Lounges. Cardholders enjoy complimentary access for themselves & up to two guests (additional guests will be charged $45/each).

Capital One opened their first lounge at Dallas/Ft Worth International Airport (DFW) in November 2021, and there plans to open lounges at Denver International Airport (DEN) & Washington Dulles International Airport (IAD) in 2022.

The DFW lounge features plenty of seating, a surprisingly eclectic buffet, a well-stocked bar, a single shower room, and even a pair of Peloton bikes. When I visited in January, I was impressed by the food & beverage options available. The coffee bar was a treat: self-serve taps dispensing cold brew coffee & a pre-mixed latte were a welcome sight after arriving on an early morning flight.

One thing to note: a confirmed seat assignment is required before entry is granted to the Capital One Lounge. This is a carbon copy of the anti-nonrev policy implemented by American Express in their Centurion Lounges a couple years ago.

This is an important distinction for non-rev travelers who don’t often receive a confirmed seat on their boarding pass until boarding time. Unfortunately, this significantly devalues the perks of the Venture X for airline employees & pass riders.

$300 Travel Statement Credit

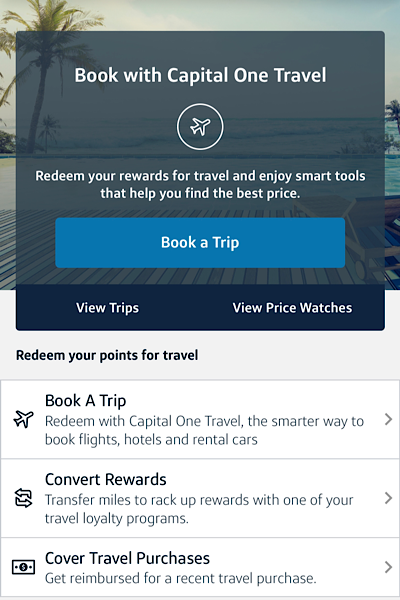

Not all travel credits are created equal! Capital One’s $300 travel credit functions much differently than Chase’s $300 travel credit on the Sapphire Reserve.

Venture X cardholders can only redeem this $300 statement credit through purchases made via Capital One’s Travel Portal. The Travel Portal’s UI is pleasant to use & the prices seem to be close to other third-party booking portals, so I don’t foresee this being an issue for regular travelers.

Airline employees & non-rev travelers have access to our own discounted interline rates through other portals, so leveraging our travel industry perks often nets us bigger discounts than what “normal” third-party portals have access to.

I wouldn’t take this $300 statement credit at face value as a nonrev (simply because you won’t find yourself using the Capital One portal as much as industry alternatives). However, it is still a nice way to significantly offset the Venture X’s $395 annual fee.

TSA PreCheck/Global Entry Credit ($85-100 value)

This feature comes standard on virtually every premium travel credit card, but it is always a welcomed addition. Capital One will provide a statement credit for any TSA PreCheck ($85) or Global Entry ($100) application fee paid using the Venture X credit card.

I always recommend paying the extra $15 for Global Entry (because it includes all of the perks of TSA PreCheck plus expedited screening for international arrivals), so getting the full $100 comped by Capital One is a no-brainer if you have this card.

This credit can be applied once every 4 years which allows cardholders to renew their membership well before the 5-year requirement set forth by TSA/CBP.

$200 Vacation Rental Statement Credit

This is a limited time bonus on top of the Venture X’s perks, but it is still available as of the time of writing. I love that Capital One offers a vacation rental travel credit with the Venture X. Staying in a hotel isn’t ideal for every type of trip, so adding a $200 credit for non-hotel stays adds a new level of flexibility.

The language in Capital One’s terms & conditions is relatively vague, but this statement credit will be automatically applied to any charges coded as “rental” (as opposed to “hotel). This definition explicitly includes purchases made with (but is not limited to) Airbnb, Turnkey, Vacasa, and VRBO.

1/14/22 update: I was pleasantly surprised to find that the Venture X’s vacation rental credit was automatically applied to hotel resort fees during a recent trip to Las Vegas. I booked & paid for a hotel along the Vegas Strip through the Capital One Travel portal, but my confirmation email indicated that a $45.30/night resort fee would be charged upon check-in. That separate charge coded as “lodging” under the hotel’s name on my credit card statement.

YMMV, but this is an encouraging data point for Venture X cardholders who want to know what charges will be covered by Capital One’s $200 vacation rental statement credit.

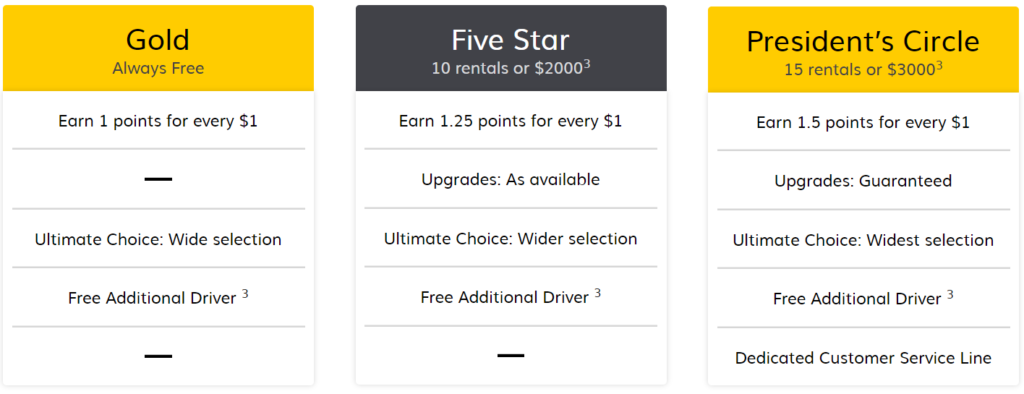

Hertz President’s Circle Status

Capital One skimped out on hotel & airline status for Venture X cardholders, but they do offer Hertz’s top-of-the-line President’s Circle status. This status is normally obtained after completing 20 rentals or spending $4,000+ at Hertz within a calendar year.

With this status, Hertz promises “guaranteed” one-class car upgrades along with a few perks like a higher earnings rate (1.5 Hertz points per dollar) & a wider choice of rental options than normal renters.

I wouldn’t go out of my way to rent from Hertz if you can find a better deal elsewhere, but President’s Circle status makes the rental process more enjoyable.

Auto Rental Collision Damage Waiver

Booking your rental car with a credit card that has auto rental protection gives you the peace of mind that you have an extra layer of protection if your car gets damaged, but did you know that different credit cards offer different levels of protection?

Because the Capital One Venture X is a Visa Infinite card, you can rest assured that this card’s rental car protection serves as primary coverage (as opposed to secondary coverage). This is important because your credit card’s primary coverage kicks in before your own personal insurance, which could save you from making an expensive claim with your insurance company. This also means that you can turn down the rental car company’s own supplemental insurance because the Venture X’s policy already covers you.

According to Capital One, this primary collision damage waiver covers “theft, damage, valid loss-of-use charges imposed and substantiated by the auto rental company, administrative fees and reasonable and customary towing charges, due to a covered theft or damage to the nearest qualified repair facility.”

Keep in mind that there are exclusions to this waiver. Expensive cars (defined as being worth more than $75,000), RVs, cargo vans, and motorcycles are among the vehicles not covered by this rental protection.

Virtual Card Number

Capital One offers cardholders the ability to begin using their account as soon as they are approved by providing a virtual card number via their app.

That means that you don’t have to wait for your physical card to show up in the mail before you start chipping away at the $4k minimum spend requirement to earn the 75k mile sign-up bonus.

Is the Capital One Venture X worth appying for?

The sign-up bonus notwithstanding, much of this card’s value is tied to how much a cardholder can take advantage of the Capital One Travel Portal.

Even as an airline employee who likely won’t use Capital One’s Travel Portal (I book most of my hotel & rental cars through my airline’s employee portal or via ID90Travel), I think there is a case to be made for the Venture X.

The Venture X is great for budget-conscious travelers who already book most of their stays through third-party booking portals and value flexibility over specific hotel/airline loyalty programs. Capital One’s Travel Portal is a fine substitute for any other online travel agency (OTA) that you have used in the past. Travel industry rates & interline prices will beat Capital One’s portal more often than not, but it doesn’t hurt to price-check.

The real value is in being able to redeem the miles as a statement credit against any travel-related charges. I have lost track of the times that I redeemed Capital One miles to pay myself for bookings made through ID90Travel. This card underperforms the competition by only earning 2% on travel purchases made outside of their portal, but the redemption process is a breeze.

As long as you can stomach the $4k minimum spend requirement, the 75K point sign-up bonus offers plenty of value. If you want the perks of a premium travel card but struggle to justify the rising annual fees of other competing credit cards, the Venture X’s $395/year annual fee looks pretty good once you factor in the statement credits.

At the end of the day, the Capital One Venture X has an incredibly enticing first-year value proposition: complimentary lounge access, PreCheck/Global Entry credit, and $1,330 worth of miles & statement credits (if you include the 2%+ earned on the $4k minimum spend) for the cost of a $395 annual fee.

If that sounds enticing to you, consider using Standby With Me’s referral link to apply for the Capital One Venture X.

Verdict from a Non-rev Traveler

The jury is still out on how valuable the Venture X card is to non-rev travelers after the first year. Capital One Lounge entry is difficult for standby travelers, the vacation rental statement credit will eventually be retired, and the earnings rate is no better than a 2% cash-back card (unless you consistently spend money in the Capital One Travel Portal). At that point, you’re paying $395/year for a Priority Pass membership & a $300 annual statement credit redeemable only through their portal.

That means the Venture X ends up with a net cost of $95 (once you subtract the $300 travel credit from the $395 annual fee) for the privilege of Priority Pass lounge access & earning two cents per dollar spent.

There are plenty of other travel credit cards that grant lounge access to non-rev travelers, but none have an annual fee as low as the Capital One Venture X. For that reason, I now prefer the Venture X over the Chase Sapphire Reserve.

Travelers who can’t justify the Venture X’s $395 annual fee can look towards Capital One’s popular Venture card ($95/year annual fee) that is currently offering a sign-up bonus worth $600.

Pingback: The 7 Best Credit Cards for Non-Rev Travelers

Thank you for this comprehensive review of the Capital One Venture X card (as well as my of your other articles). As you mentioned, assess to Capital One lounges with a non-confirmed seat is crucial and I guess we’ll just have to wait and see if there are data points that either confirm or deny its feasibility.

I especially appreciate the slightest hint that purchases made through ID90travel do in fact code as a travel charge on this particular card. I couldn’t find it anywhere whether that’s the case for Capital One (and I still don’t know if it’s true for say Chase or Amex). You mention that is extremely appreciated. Thanks for a great read and all the travel hacks!

Pingback: 9 Credit Cards that Allow Nonrevs into Airport Lounges

Pingback: Does the Capital One Venture X offer a virtual card number?

Awesome, article and website in general!

As noted above, it looks like a confirmed seat is required to enter the Capital One lounge. Is that a speculation or do we have confirmed data points on this? Any information you can provide is greatly appreciated! This is going to play an important role in my decision to get the card, as it would be limited to PP only for lounge access since my wife and I usually travel non-rev for the most part.

Thank you so much for all info! Please keep sharing!

I have used the Cap One lounge while non-revving this year. I love the lounge and hope that continues for me.

Thanks for a great article. Well I understand the centurion lounges are no good for non-revs, that your ex does give Priority Pass access to their lounges. Can non revs easily access Priority Pass lounges? If so, wouldn’t that make the venture x a great card to go with as an non rev?